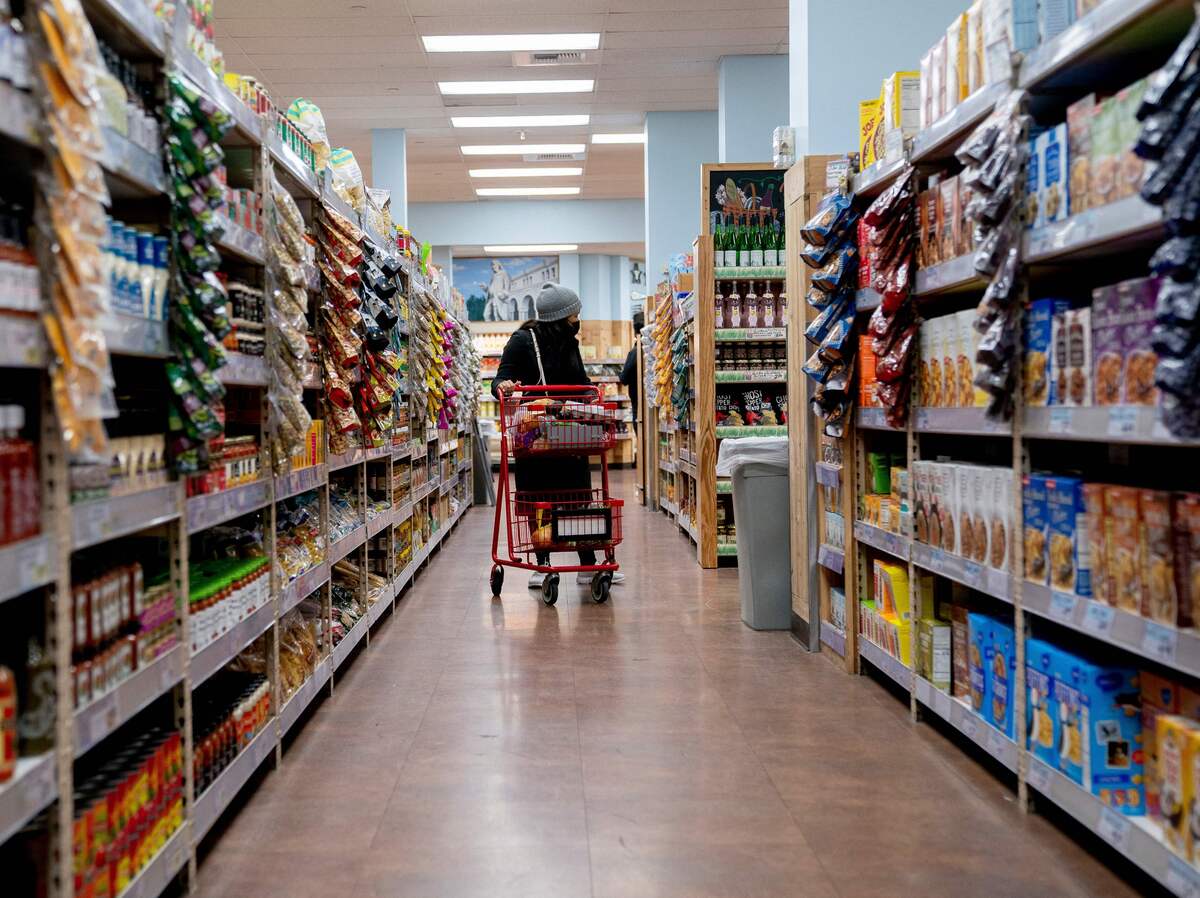

A shopper walks into a grocery store in Washington, D.C., on March 13. Soaring inflation poses a particular challenge to working-class families, affecting the cost of basic necessities such as groceries.

Stephanie Reynolds/AFP via Getty Images

Hide caption

Caption switch

Stephanie Reynolds/AFP via Getty Images

A shopper walks into a grocery store in Washington, D.C., on March 13. Soaring inflation poses a particular challenge to working-class families, affecting the cost of basic necessities such as groceries.

Stephanie Reynolds/AFP via Getty Images

From high rent to high heating bills, high inflation affects everyone, but it is especially difficult for people who have a little extra money to spare.

On Tuesday, the Labor Department is expected to report that consumer prices in March rose more than 8% from a year ago, a sharper jump from 7.9% the previous month. That would leave inflation at its highest level since 1982.

While no one likes paying more for haircuts or hamburgers, high inflation is particularly painful for low-income families, whose spending is heavily geared toward necessities like groceries and gasoline, and which have seen some of the biggest price increases.

These families have a bit of fat in their family budgets to begin with, so when inflation drops below their limited purchasing power, we have something to give.

Take Laura Kemp, a widow in Moldo, Oklahoma, who says her heating bill last month was $306, more than double the $125 she paid a year ago.

“I live in a two-bedroom mobile home,” she says. “I don’t understand what’s going on. Every month it increases and takes about a third of the income.”

Kemp feels it’s losing ground, as even small indulgences like a McDonald’s meal have run out of price.

“By the 10th of the month, I have $200 left,” she says. $200 a month now goes to my fuel tank.

“I’m not going to reach the end of the month anymore,” she says. “Even getting a Big Mac now – an $8 Big Mac – I can’t stand it.”

When the weather warms up, Kemp plans to plant a vegetable garden in hopes of paying her food bill. She’s been picking seeds for tomatoes, zucchini, peppers, and eggplant, and she’s looking forward to some of the land her brother owns – where her caravan also sits.

Community volunteers cut and prepare fruit at a food bank in Houston on February 8.

Brandon Bell / Getty Images

Hide caption

Caption switch

Brandon Bell / Getty Images

Community volunteers cut and prepare fruit at a food bank in Houston on February 8.

Brandon Bell / Getty Images

From groceries to rent, prices are rising everywhere

Charlene Ray, who retired after 28 years in the poultry industry — most of that time in chicken processing plants — finds herself having to make tough choices after chicken prices have risen sharply over the past year, like everything else in the grocery store.

“You have to be more careful with what you cook, the things you make, and the things you buy,” she says.

Rye is receiving help from a food pantry in Salisaw, Oklahoma, which is getting busier as prices have risen.

“They open at 10 a.m., and if you’re there at 9, people are already in line,” she says.

For Terrie Dean, it’s the cost of housing that really bugs you. She and her teenage son live temporarily in a hotel in Salisau. She relies on disability payments of about $1,600 a month, which puts the apartment out of reach at the moment.

“They want the first month and the deposit, unaware that it might be all this family brings,” Dean said.

Low-income families typically spend about 45% of their income on housing, compared to 18% for higher-income families.

Gasoline prices hover around $4 a gallon of the least expensive grade at many gas stations in Washington, D.C., on April 11.

Chip somophila / Getty Images

Hide caption

Caption switch

Chip somophila / Getty Images

Gasoline prices hover around $4 a gallon of the least expensive grade at many gas stations in Washington, D.C., on April 11.

Chip somophila / Getty Images

Gas prices tend to be particularly affected

The disparity in food and transportation is also greater – 9% of the budgets of high-income households are consumed while 26% are consumed by low-income households.

After the Russian invasion of Ukraine, gasoline prices jumped to $4.33 a gallon in March – its highest level ever, unadjusted for inflation.

Increased gas prices can affect family ties. High energy prices have forced Chicago’s Patricia Bridgemon to cut back on visits to her elderly mother in Hammond, Indiana, about 25 minutes away.

“It’s awful with gas,” she says. “I usually go see her three days out of the week. Now, it’s down to one day, because of the gas.”

Kemp, a widow with an increased heating bill, has also cut back on driving to Fort Smith, Ark, about 35 minutes from her home in eastern Oklahoma.

“I love going to art museums, shopping at thrift stores, and just getting out,” she said. “But I can’t even go anymore.”

Meanwhile, Ray, a retired poultry worker, has to weigh the cost of driving to a larger supermarket away from shopping closer to home, where prices are higher, even in good times.

Federal Reserve Governor Lyle Brainard at her hearing in Washington, D.C. on January 13 after President Biden proposed her to serve as Vice President of the Central Bank.

Drew Angerer / Getty Images

Hide caption

Caption switch

Drew Angerer / Getty Images

Federal Reserve Governor Lyle Brainard at her hearing in Washington, D.C. on January 13 after President Biden proposed her to serve as Vice President of the Central Bank.

Drew Angerer / Getty Images

The Federal Reserve plans to act aggressively to fight inflation

Federal Reserve officials are well aware of the toll that inflation is taking, particularly on lower-income households, a point made by Federal Reserve Governor Lyle Brainard in last week’s speech.

“While all Americans face higher prices, the burden is especially great for families with limited resources,” Brainard said. That is why lowering inflation is our most important task, while maintaining an inclusive recovery.

The Fed began raising interest rates last month in an effort to curb consumer demand and control prices.

The central bank started slowly, raising interest rates by a quarter of a percentage point. But markets expect the Fed to become more aggressive, with a half-point increase now widely expected at the Fed’s next meeting in early May.

Although forecasters say March could hit a high level of inflation, consumer prices are likely to continue rising at an uncomfortable rapid pace for the rest of this year, while continuing to put special pressure on families who can’t afford them.

“Certified music scholar. Freelance analyst. Social mediaholic. Hipster-friendly web nerd. Zombie buff.”